Enterprise Class flights, upgrades to lodge suites, personal lounge entry at airports and chain motels…these are all of the area of the rich and the frequent government vacationers, proper? Not essentially. You’ll be able to be part of their life-style at any time if you happen to faucet into the correct bank card perks for vacationers.

Each every so often I’ll be on a tour or staying at a lodge the place I can’t assist however hear the conversations round me. Typically I hear one thing that makes me cease what I’m doing and pay attention. As soon as I used to be on a visit to Peru the place on the desk subsequent to me, one traveler requested, in amazement, “Why would you utilize a debit card to pay for an $8,000 tour? Are you out of your thoughts?!”

The recipient of this query mumbled one thing about accountable spending and never going into debt, however the others three on the desk hit him with a barrage of arguments about why this was a dumb transfer. On the finish it had him saying, “Okay, OKAY—I get it. So what journey card ought to I get?”

On the one hand, you’ve received to admire a man who received to retirement age with out placing issues on a bank card. That restraint and financial accountability are admirable. Then again, half the individuals at that desk I used to be eavesdropping on had not paid for his or her flight—they cashed in frequent flyer miles to get to Peru. All of them had been staying on an additional day or two without spending a dime additionally: they cashed in lodge factors to spend additional time in Lima.

This man, then again, had laid out loads of actual cash to get there and was flying dwelling the day the tour was over. All of them paid the identical quantity for the tour upon arrival, however they definitely didn’t pay the identical quantity for transportation or lodging. Plus those enjoying the bank card perks sport received an additional 8K factors at a minimal once they put the price of the tour on the correct card.

Journey Hacking Vs. Leaving Cash on the Desk

Because it got here out within the dialog I used to be eavesdropping on, there are those that exploit the alternatives to raise their journey and people who don’t even know the alternatives exist. The previous are showered with perks, the latter—accountable as they could be with their cash—find yourself wanting like suckers. “Do you need to pay to test a bag?” one requested. “Do you’ve World Entry and TSA Pre-check paid for?” requested one other. “Do you get a room improve if you test right into a lodge?” a 3rd chimed in.

The purpose they had been making—and it wasn’t laborious to make—was that getting the correct bank cards could make your journey life much more nice. In case you cost issues and by no means pay any curiosity since you pay the cardboard off every month, you then’re solely out the annual payment. With some playing cards the annual payment pays for itself (or near it) due to the anniversary bonuses they provide you for sticking round.

Except you by no means take a flight or keep at chain motels after getting the cardboard, it’s nearly not possible that even an informal leisure traveler received’t come out forward. Plus the travels will likely be extra comfy due to your elevated standing.

The lodge and airline loyalty applications are a sport. Those that play the sport can win huge and get showered with journey perks and the sport is definitely fairly laborious to lose. The one individuals who actually lose badly are those that don’t play in any respect. You’ll be able to seize a few of the cash on the desk or you possibly can depart the money sitting there.

Airline Credit score Card Perks

In case you fly a sure airline (or their alliance) lots, it’s a no brainer to get one in all that airline’s bank cards. If there’s a juicy sign-up bonus being provided, then you may find yourself with a free worldwide flight with out even incomes a single mile from flying. And today, you don’t earn a lot by flying, so getting the correct card will earn you extra anyway simply from placing payments and gasoline pump fees on the cardboard.

In case you get the Amex Gold Delta Skymiles card, as an illustration, with the provide as I write this you will get 50,000 miles after assembly the minimal spend in three months. I’ve seen extra beneficiant gives from them previously, however that may typically get you to South America and again if you happen to’re versatile along with your dates, or at least pay for a visit to Mexico.

Perks embody a home free bag test, precedence boarding, tk. Spend $10K on it in a single yr and also you’ll get a $200 flight credit score too. I managed to try this in 2024 by placing plenty of payments on the cardboard and halved the value of one in all my tickets. See the main points right here.

You’ve received to pay this one off each month although. The rate of interest begins at 20% after which rises additional into mortgage shark territory.

The American Airways card from Citi additionally has super-high rates of interest beginning at 20% and the identical underwhelming 50K provide at present. As with Delta, their free checked bag perk solely applies to home flights, so this one is healthier for US journey than worldwide flights the place there’s a bag payment, like ones to Mexico. (United’s card covers a bag on all flights although, in order that’s a greater one to get if you happen to’re not close to a hub for AA or Delta.)

The AA card has one enormous benefit although if you happen to fly American sufficient to get to elite standing: factors from bank card spending rely as elite miles. So it’s lots simpler to purchase your solution to standing and further perks on AA than it’s on the others. One huge drawback for Latin America although: there is no such thing as a different OneWorld alliance accomplice that may get you to Central or South America. Their solely accomplice within the Americas left is Alaska Air.

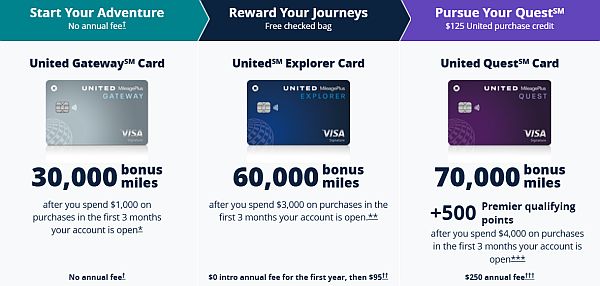

The United Airways Explorer Card is my high decide for airline bank cards as a result of it has the most effective perks by far. As talked about above, you get a free checked bag on all flights, not simply those inside the USA. You’ll be able to see the three selections beneath, with the next annual payment getting extra extras, however the Explorer one with a 60,000-point sign-up bonus has a $99 payment, which is decrease than the 2 above however offer you extra factors up entrance.

You’ll be able to simply cowl the annual payment with saved baggage charges plus there’s one other enormous benefit that the others don’t provide: the Chase United Explorer and Quest playing cards include two free lounge passes per yr. That alone nearly cancels out the annual payment. Plus you don’t even pay the annual payment till the renewal date, not the primary yr. Final, United is a part of the Star Alliance, which suggests you possibly can earn or use factors on Copa Airways or Avianca.

They’ve an alternative choice I minimize off within the photograph above since you pay greater than $500 a yr simply so as to add lounge entry. There are different methods to get lounge entry that received’t be so expensive until you might be in one in all their hubs each month and can actually use it lots.

Whereas the bonus is probably not as excessive at first look, 40,000 factors as I write this, you may also get a free flight to Central America or Mexico with the Southwest Chase card. In some methods these factors are price extra too. Southwest has a really standardized redemption method that’s simply associated to the price of the flight, with no “dynamic pricing” factors adjustments on excessive demand days and no blackout dates. So these factors are a lot simpler to money in without spending a dime flights than with the opposite legacy carriers. Plus no bag charges ever.

There’s only one huge draw back with this Southwest card although, an odd one for an airline card: it fees international transaction charges. So that you don’t wish to use it outdoors of the USA as a result of that’s simply handing more money for nothing to Chase.

They not offer you free drink tickets in your card anniversary, however they do deposit a couple of thousand additional miles in your account, which offsets a few of the annual payment. That annual payment is the bottom of the most important airline playing cards too, at $69.

In case you fly to Latin America a number of occasions per yr on a particular airline, chances are you’ll wish to look into ones provided by a international provider. The Avianca one has a popularity as being essentially the most beneficiant with its factors, however you may also get ones from Aeromexico, Copa, or LATAM.

The Pleasure of Having a Lodge Branded Credit score Card

Whereas an economic system seat on an airline may not get you very excited, how about computerized room upgrades and free lodge nights at a luxurious property?

Not all lodge loyalty program playing cards are created equal as a result of the applications aren’t as comparable because the airline ones. Some could have simple redemption at 15,000 factors, whereas on others which may not even get you right into a motel. I’ve playing cards from Hilton and IHG personally. The primary I received as a result of the sign-up bonus was enormous and I ended up getting three nights on three events simply from the sign-up bonus.

The Hilton card provide varies, however proper now it’s a whopping 165,000 factors for his or her Surpass card with a $150 annual payment. I take advantage of this one and the IHG one beneath regularly, scoring 16 free nights between the 2 of them final yr. With so many factors awarded to you up entrance and the benefit of increase extra by way of their spending multipliers, you may simply money in for a few nights on the Conrad Punta de Mita or Waldorf-Astoria Panama Metropolis.

Guide this resort with Hilton loyalty factors earned with bank card spending

You get Gold standing routinely when you’ve this card too, which may result in journey perks like room upgrades, free breakfast, or government lounge entry.

I’m a giant fan of the IHG Rewards card from Chase. I’ve had it for greater than a decade now. I don’t find it irresistible as a result of their motels total are all that luxurious—although they do now have Kimpton and Six Senses within the combine—however as a result of the purpose cash-in ranges are fairly affordable. You’ll be able to typically get into an Intercontinental or Crowne Plaza for some extent complete that’s typically half what you see for a comparable property at Marriott.

Plus yearly upon renewal they provide you a free evening for any lodge as much as 40K factors, which is nice to money in if you want an airport lodge or a street journey cease and don’t really feel like laying out the cash for that. I’ve cashed in factors with them in Mexico, Nicaragua, Costa Rica, Chile, Argentina, and Colombia simply in Latin America, extra in Europe and the USA.

As I write this, if you happen to get the IHG Rewards One Premier card that I’ve, you get 4 free nights at properties valued at 40K factors or much less after assembly the minimal spend. I can inform you from expertise that a lot of the Intercontinental properties in Latin America will are available in underneath that most if it’s not a vacation weekend and now there’s a Kimpton in Mexico Metropolis and one in Roatan, Honduras that we’re hoping to take a look at quickly.

This IHG bank card offers you Platinum Elite standing, which suggests you’ll often get upgraded to a greater room and generally you get perks like lounge entry, snacks, or a partial factors rebate.

There are different lodge card choices in fact if you happen to desire a distinct chain. The Hyatt one is sort of good by way of what you get from the bonus and spending, the Marriott one not a lot due to very excessive (and complex) redemption ranges. The best one is through Barclays for Wyndham Rewards, which solely has three redemption ranges, however they don’t have many luxurious properties in Latin America.

Journey Credit score Playing cards With Convertible Factors

There’s additionally a bonus to having an Amex card with Membership Rewards or, possibly even higher, a Chase Sapphire Rewards card. With these you’ll pay extra, however you possibly can switch your miles to a number of applications, providing you with the flexibility to “high off” your account to get to an award tier you want for a visit.

The very best stage of these playing cards additionally get you a number of perks like reimbursement for World Entry, reimbursement for bag charges, Precedence Go membership, and within the case of Amex, entry to their very own Centurion lounges.

In case you solely fly enterprise class or above, that’s okay. Use these factors to high off your complete and also you’ll have sufficient to improve or convey a partner. Plus you’ll earn enormous bonuses if you cost flights to those playing cards. Even if you happen to don’t have standing on a specific airline, you’ll get some bank card perks that prevent cash or pace up your journey.

There’s a 3rd possibility for this you don’t hear as a lot about. Capital One has a premium card that permits transfers to completely different applications, plus they together with Precedence Go lounge entry for you and a few different individuals. That is the subsequent one I’m going so as to add to my pockets as a result of I’ve received a few actually lengthy layovers developing this yr.

Which Credit score Card Perks Are Proper for You?

Which card do you have to get for the most effective journey perks?

Nicely if that man on the desk subsequent to me in Peru had posed the query, I wouldn’t have answered instantly. I might have requested him the place he lives, what airline he flies essentially the most, and how much motels he stays in. As I famous in this earlier publish, you might have entry to completely different lodge manufacturers than the obvious with a few of these lodge playing cards. However a card for an airline you by no means fly isn’t of a lot use.

I might additionally inform him, nonetheless, to neglect getting only one. Ideally, it’s best to at the least have one airline card, one lodge card, and one bank card that lets you transfer factors to completely different accounts as wanted. This fashion you’ve received the most effective likelihood of getting all of the bank card perks out there.

Positive, that’s going to price you a couple of hundred bucks a yr come renewal time, however you’ll simply earn that again from all the additional goodies you obtain.

If conserving observe of three playing cards makes your mind harm, then simply get the Chase Sapphire Most popular card so you possibly can switch factors to completely different accounts. You additionally get a rebate if you e book journey with them, plus you earn factors extra shortly with them than with Amex: 5X on purchases by way of Chase Journey, 3X on eating, 2X on different journey purchases.

Then as an alternative of spending $8,000 on a debit card that doesn’t do something for you, as an alternative you may be getting comped flights, free lodge rooms, and perks that the common clients by no means see. Simply float that spending for a month and the journey hacking rewards will be enormous, even for luxurious vacationers.

Get on our insiders checklist and obtain our month-to-month updates. Be a part of us right here and also you’ll get a free report on easy methods to get a lodge improve extra typically if you journey.

Disclosure: Luxurious Latin America is free to learn as a result of it’s reader-supported by way of promoting. Some hyperlinks on this publish could present us some compensation within the type of small commissions or loyalty factors. They may by no means price you greater than if you happen to went to the positioning straight.